Transform Your eInvoicing Journey with Our Phase II, eInvoicing Service

Elevate efficiency and accuracy in your financial processes. Our ZATCA compliant Phase II eInvoicing solutions seamlessly integrate with Tally ERP, Dynamics 365, and SAP, simplifying your invoicing tasks and revolutionizing your business. Simplify your invoicing with our eInvoicing solutions. Eliminate manual errors, streamline workflows…more

experience the extraordinary

Automated Invoicing

Reduce manual effort with

automated invoicing processes

Seamless ERP Integration

Integrate effortlessly with Tally ERP, Dynamics 365,

and SAP for a cohesive financial ecosystem.

Error Elimination

Minimize errors and ensure accurate

transactions with our einvoicing solutions

Time-Efficient

Save time on invoicing tasks,

Tally ERP, Dynamics 365, and SAP

What is GoAgile's eInvoicing Solution?

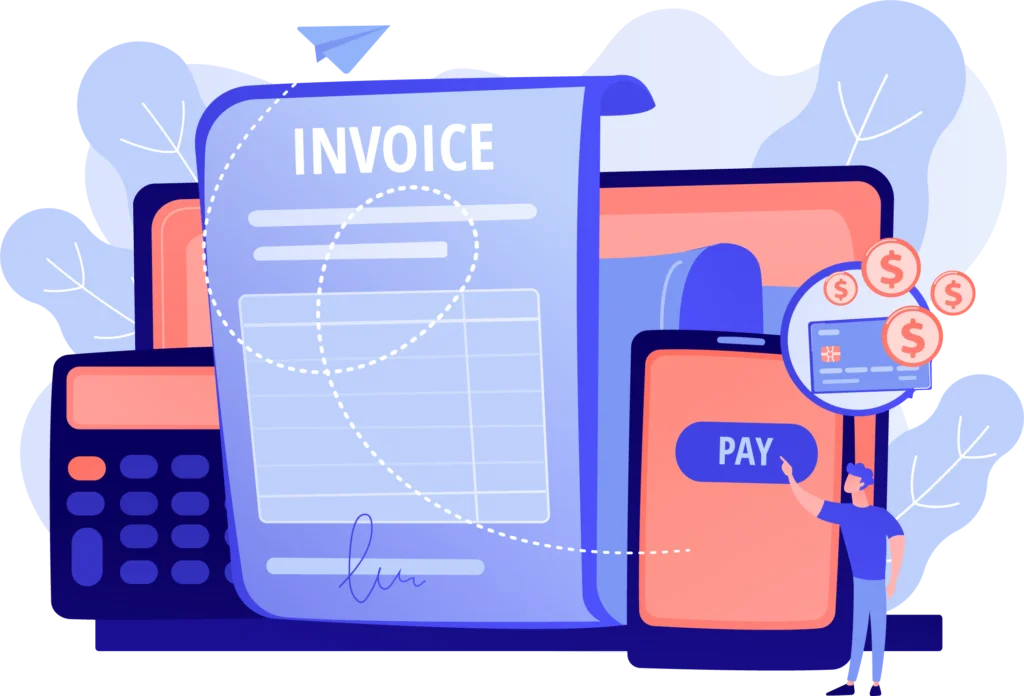

In today’s fast-paced business world, accuracy and efficiency in financial transactions aren’t just perks—they’re necessities. Enter GoAgile, your partner in revolutionizing invoicing!

Our cutting-edge eInvoicing Solution transforms the way businesses handle billing by:

- Streamlining your invoicing process

- Eliminating errors

- Ensuring compliance with regulations

Whether you’re a small startup or an established enterprise, GoAgile’s secure and seamless eInvoicing services deliver:

- Enhanced accuracy

- Faster payment cycles

- Lower administrative costs

Say goodbye to paper trails and hello to smarter invoicing! Join the wave of businesses already benefiting from GoAgile’s innovation and take your billing to the next level.

GoAgile: Your gateway to a more efficient, paperless future.

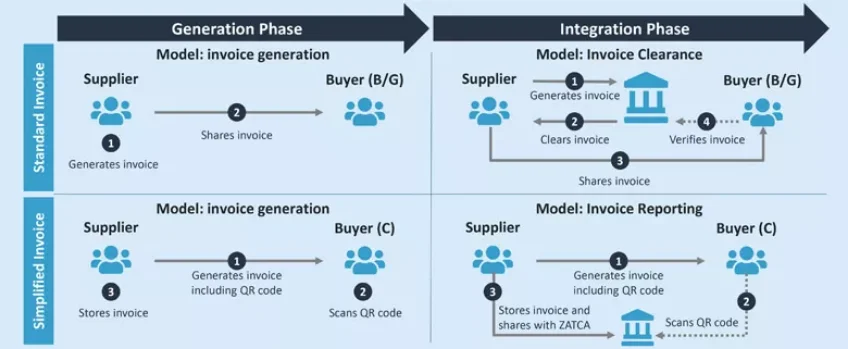

einvoicing and Tax Invoices in Saudi Arabia

eInvoicing in Saudi Arabia is a significant regulatory development implemented by the Zakat, Tax and Customs Authority (ZATCA). The eInvoicing mandate requires businesses to generate and store invoices electronically, ensuring compliance with VAT regulations.

This process includes the issuance of tax invoices and simplified invoices, which must adhere to specific standards and formats set by ZATCA.

Key Components of eInvoicing in Saudi Arabia

Tax Invoices: These are issued for B2B transactions and must include detailed information such as the VAT number of both the supplier and the customer, invoice date, and total amount including VAT.

Simplified Invoices: These are typically used for B2C transactions and require less detailed information compared to tax invoices but still need to comply with ZATCA’s standards.

Integration Waves and Company Revenue Thresholds

The implementation of eInvoicing in Saudi Arabia is being

rolled out in phases, with different deadlines and requirements

based on company revenue thresholds. This phased approach

ensures that all businesses have adequate time to comply with

the new regulations.

Phase 01 (Generation)

Phase 01 (Generation) Started on December 4, 2021. All taxpayers subject to VAT were required to generate and store invoices electronically.

Phase 02 (Integration)

Also known as the “Integration Phase,” it began on January 1, 2023. This phase mandates the integration of taxpayers’ eInvoicing systems with ZATCA’s platform for real-time invoice sharing and validation.

Integration Waves Based on Revenue Thresholds

Wave 1: Applies to businesses with annual revenues exceeding SAR 3 billion.

These businesses were required to comply by January 1, 2023.

Wave 2: Targets businesses with annual revenues exceeding SAR 500 million.

The compliance deadline was July 1, 2023.

Wave 3: Includes businesses with annual revenues exceeding SAR 100 million.

The deadline for these businesses is January 1, 2024.

Subsequent Waves: Future waves will progressively include smaller businesses,

ensuring all taxpayers are eventually covered under the eInvoicing mandate.

Frequently Asked Questions

eInvoicing, or electronic invoicing, is the process of sending and receiving invoices in a digital format. It eliminates the need for paper-based invoices and allows for seamless integration with your accounting software, ensuring accuracy and efficiency.

GoAgile’s eInvoicing solution works by integrating with your existing financial systems to send, receive, and process invoices electronically. Our platform automates the entire invoicing process, from invoice creation to payment, ensuring a smooth and error-free workflow.

eInvoicing offers numerous benefits, including:

Reduced paperwork and administrative costs

Faster payment cycles

Improved accuracy and reduced errors

Enhanced security and compliance with regulatory standards

Better tracking and reporting capabilities

Yes, security is a top priority for us. Our eInvoicing solution uses advanced encryption and secure protocols to ensure that all your financial data is protected. We also comply with industry standards and regulations to provide you with a secure invoicing platform.

Absolutely. Our eInvoicing solution is designed to integrate seamlessly with most accounting and ERP systems. This ensures a smooth transition and allows you to continue using your existing software while benefiting from the advantages of eInvoicing.

Getting started is simple. Contact our sales team to schedule a consultation. We’ll assess your current invoicing processes and provide a tailored solution to meet your needs. Our team will assist you with the implementation and provide ongoing support to ensure a successful transition to eInvoicing.

eInvoicing is beneficial for businesses in various industries, including retail, manufacturing, healthcare, finance, and more. Any business that handles invoicing can benefit from the efficiencies and accuracy provided by eInvoicing.

Our eInvoicing solution meets all relevant local and international compliance standards, ensuring that your business remains compliant with regulatory requirements. We stay updated with the latest regulations to provide you with a solution that is always in line with current standards.

Yes, eInvoicing contributes to sustainability by reducing the need for paper-based invoices, thereby lowering your environmental footprint. It’s an excellent step towards a more sustainable and eco-friendly business practice.

We provide comprehensive support to ensure the success of your eInvoicing implementation. Our team is available to assist with any questions or issues that may arise, offering continuous support and regular updates to keep your system running smoothly.

Ready to Revolutionize Your Invoicing Experience?

We provide comprehensive support to ensure the success of your einvoicing implementation. Our team is available to assist with any questions or issues that may arise, offering continuous support and regular updates to keep your system running smoothly.